Getting My Mileagewise - Reconstructing Mileage Logs To Work

Wiki Article

Not known Facts About Mileagewise - Reconstructing Mileage Logs

Table of ContentsGetting The Mileagewise - Reconstructing Mileage Logs To WorkMileagewise - Reconstructing Mileage Logs - The FactsSee This Report about Mileagewise - Reconstructing Mileage LogsThe Mileagewise - Reconstructing Mileage Logs IdeasThe 45-Second Trick For Mileagewise - Reconstructing Mileage LogsTop Guidelines Of Mileagewise - Reconstructing Mileage LogsSome Known Details About Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Distance feature recommends the quickest driving route to your workers' destination. This attribute enhances efficiency and adds to cost financial savings, making it a vital property for organizations with a mobile workforce. Timeero's Suggested Route function even more increases accountability and efficiency. Workers can contrast the suggested route with the actual path taken.Such a method to reporting and compliance streamlines the usually complex task of managing gas mileage expenditures. There are several advantages associated with making use of Timeero to maintain track of gas mileage.

Getting The Mileagewise - Reconstructing Mileage Logs To Work

With these tools being used, there will certainly be no under-the-radar detours to enhance your repayment costs. Timestamps can be discovered on each gas mileage entry, enhancing credibility. These added verification actions will certainly keep the internal revenue service from having a reason to object your gas mileage records. With exact gas mileage tracking innovation, your staff members do not need to make harsh gas mileage price quotes or perhaps bother with gas mileage expenditure monitoring.

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all auto expenditures. You will require to proceed tracking gas mileage for work also if you're using the actual expenditure approach. Maintaining gas mileage documents is the only way to separate business and personal miles and give the proof to the IRS

A lot of mileage trackers let you log your journeys by hand while determining the distance and repayment amounts for you. Lots of likewise included real-time journey monitoring - you require to start the app at the beginning of your trip and stop it when you reach your last destination. These apps log your beginning and end addresses, and time stamps, in addition to the complete distance and repayment amount.

The 8-Minute Rule for Mileagewise - Reconstructing Mileage Logs

One of the inquiries that The IRS states that lorry costs can be considered as an "average and required" price throughout operating. This consists of costs such as fuel, upkeep, insurance, and the automobile's depreciation. Nonetheless, for these prices to be considered deductible, the lorry needs to be used for service purposes.

The 10-Minute Rule for Mileagewise - Reconstructing Mileage Logs

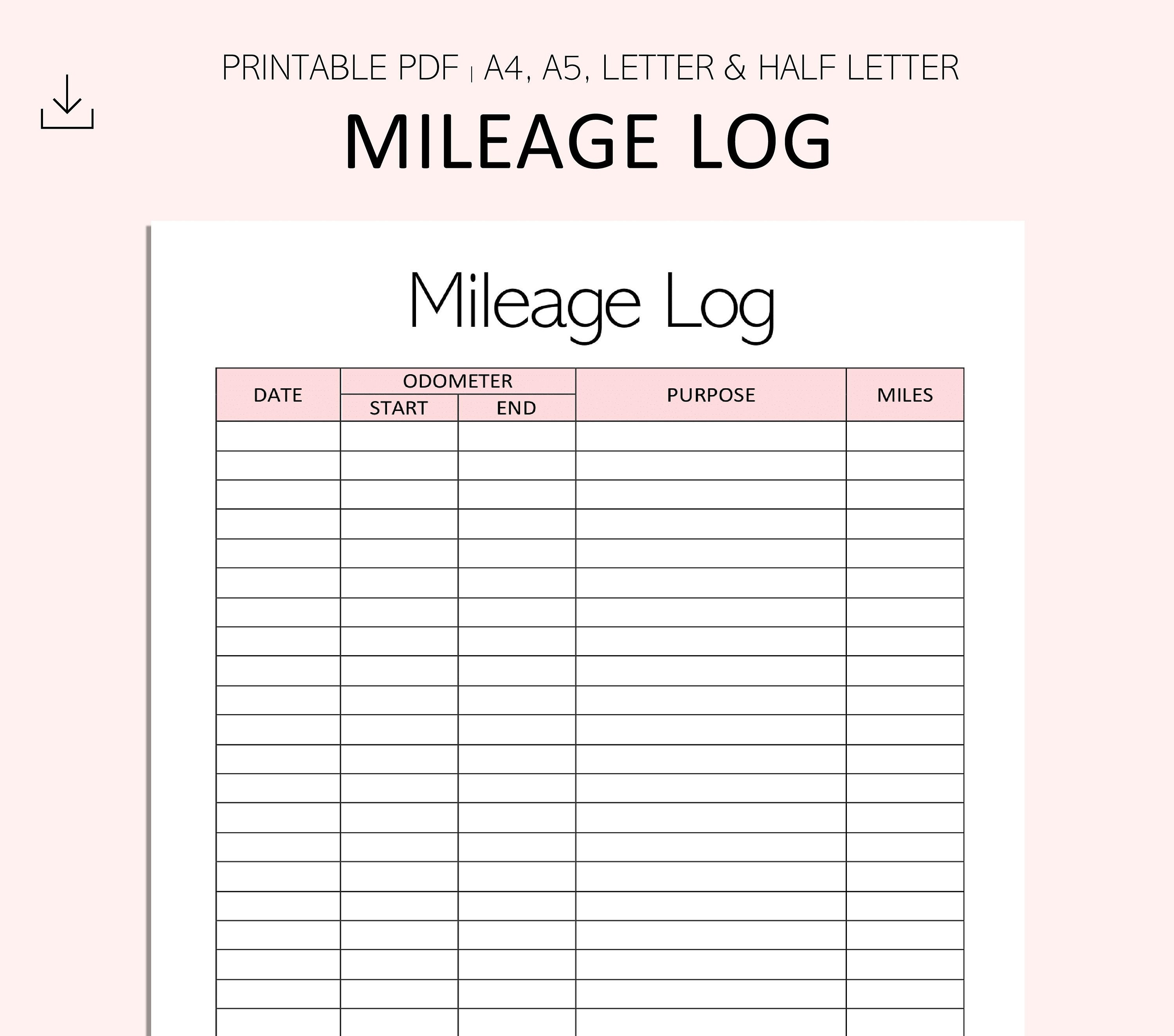

In in between, diligently track all your company journeys keeping in mind down the beginning and finishing analyses. For each journey, record the place and company purpose.This includes the overall service mileage and complete mileage accumulation for the year (organization + individual), trip's date, destination, and objective. It's vital to videotape tasks promptly and keep a coexisting driving log outlining day, miles driven, get redirected here and business purpose. Below's just how you can improve record-keeping for audit objectives: Start with making certain a precise gas mileage log for all business-related traveling.

The 10-Minute Rule for Mileagewise - Reconstructing Mileage Logs

The real expenses technique is an alternative to the conventional mileage price technique. Rather of determining your deduction based on a predetermined rate per mile, the actual expenditures approach enables you to subtract the actual prices linked with using your car for company purposes - best free mileage tracker app. These expenses include gas, upkeep, repair services, insurance, depreciation, and various other associated costsThose with significant vehicle-related expenses or one-of-a-kind conditions might benefit from the real expenses approach. Eventually, your picked method should align with your particular economic goals and tax circumstance.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

(https://www.indiegogo.com/individuals/38205225)Determine your overall business miles by utilizing your start and end odometer analyses, and your videotaped company miles. Properly tracking your exact mileage for company journeys help in confirming your tax reduction, especially if you choose for the Standard Gas mileage technique.

Maintaining track of your gas mileage by hand can require diligence, but remember, it could conserve you money on your tax obligations. Tape the total gas mileage driven.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

And now nearly everybody uses General practitioners to get about. That means almost everyone can be tracked as they go regarding their company.Report this wiki page